If you are trying to manage your cashflow position and looking toward building and maintaining wealth, creating a budget is essential.

By sitting down and completing a budget, you create a snapshot overview of your personal financial position. In doing so, you give yourself the opportunity to gain a better understanding of the movement of your money – inflows and outflows. This information can help you work out how to achieve your financial goals and objectives, such as paying down debt or investing for the future.

The 50 / 30 / 20 budgeting rule

There are many ways to manage your budget. One popular tool is the 50 / 30 / 20 budgeting rule.

Essentially, this budgeting rule provides a rough guide as to how your money should be allocated towards your needs, wants and savings. For example:

- 50% NEEDS: 50% is allocated towards needs, such as rent or minimum home loan repayments, transportation, groceries, minimum credit card and car/personal loan repayments, insurances, education, utilities, private health insurance, phone and internet, etc.

- 30% WANTS: 30% is allocated towards wants, such as daily coffee, eating out, shopping, entertainment (e.g. subscription services, such as Netflix), hobbies, holidays, etc.

- 20% SAVINGS: 20% is allocated towards savings, such as emergency funds, savings accounts (e.g. saving for a new car or a housing deposit), additional debt repayments, as well as investments inside and/or outside of superannuation.

Do you know what percentage you are currently allocating towards your needs, wants and savings?

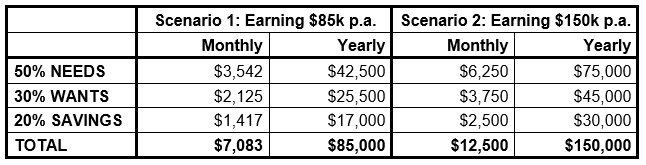

Here is an example of how this budgeting rule would apply if you were earning $85,000 per annum (after tax) or $150,000 per annum (after tax).

Do you feel confident that you are meeting your savings goals?

Things to Consider

The 50 / 30 / 20 budgeting rule should be used as a guide only. It encourages you to consciously consider how you want to spend your money – how much would you like to allocate to discretionary spending vs saving for the future. One of the benefits of using percentages is that it allows you to update your budget as your income and needs change over time.

The key to this approach is to make sure the percentages you use to divide up your income make sense for you and your long term financial goals. Depending on your personal circumstances, you may need to adjust the percentage allocations. For example, low income earners who live in expensive areas, may require more than 50% of their income for needs. Or high income earners may want to consider allocating more than 20% to savings rather than spending it on wants.

It’s important you use this budget rule as a guide only. You should also consider getting professional advice about how you can best utilise your current financial position to achieve your long term goals and objectives.

Once you have come up with your budget, the next step is to track your spending over the course of a year to ensure you are sticking to your budget. If you need help developing a budget or tracking your spending, please contact us for assistance.

This information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, you should consider whether the information is appropriate in light of your particular objectives, financial situation and needs. For further information on anything that has been discussed in this article, please consider seeking qualified and professional advice.

Sources: https://iress.financialknowledgecentre.com.au/kcarticles.php?id=1877

Photo by Towfiqu barbhuiya on Unsplash